Have you tried budgeting before and you find it just doesn’t work for you? Then you get frustrated because you think maybe you're doing something wrong and you just give up. Maybe it's not you and the problem is actually the budget. Most of the templates you encounter online make you total your income and expenses for the whole month. Guess what? That’s not how real life works! We don't get our income and expenses in a whole lump sum.

When it comes to expenses it's not linear. Expenses come in various forms. You have bills with due dates, expenses that are variable, and expenses that have to be saved up long-term.

I’ll provide you step-by-step what you need to do to create a budget that’s aligned with the way you live your life. Get ready to get your mind blown with this paycheck budgeting method that will help you finally get ahead financially, is easy to manage, and can help you get out of the paycheck to paycheck cycle.

Step 1: Get Organized

Make a list of all your bills that have due dates. For this you can log into your checking account from last month to refresh your memory of all the typical bills you have in a given month. Then if you need to you can go online to review statements to verify due dates and amounts.

Typical bills with due dates for example are:

You might be wondering why you have to do all this if maybe you only have a few bills. The thing is you don't want to waste mental energy on trying to remember this information. For this reason this step is so important. It lets us dump all the information into one place where we can see all the bills, amounts, and due dates. Not only that but it allows us to lay the framework for the paycheck budgeting system. You’ll be able to see all the bills that need to get paid between paychecks. This makes it easy when your paycheck comes you know exactly what bills to pay from that paycheck. Simple, right?

Step Two: Create a Spreadsheet for your Paycheck Budgeting System

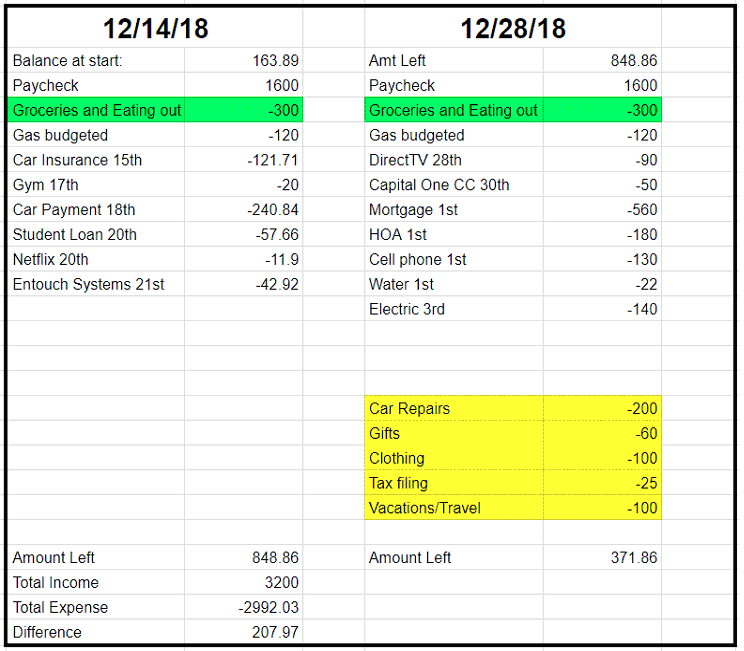

Now this part is my favorite part but that's only because I'm an Excel nerd. Don’t worry. You don’t need to be a wiz at this. I’ll give the steps set this up for yourself and an example is provided below. First you list out the dates for your next three paychecks and put them at the top of each column. Then under the first paycheck date enter the balance amount in your checking. Below that line you'll put the paycheck amount. Now you're ready to list all your bills that will be between the first paycheck and the next paycheck. Make sure to list them in order by due dates. The next step is putting down the amount of your recurring expenses for the month. This can be for example groceries, eating out, and gas. This type of expense may vary month to month. Make sure the expenses have a negative sign in front of the number as this amount is being subtracted from your paycheck.

Once all bills and recurring expenses are listed out go ahead and enter the sum formula to total it all out. This amount will be the amount left in your bank account. You will then use that amount to start off with your next paycheck on the next column and so on.

Step Three: Put your plan into action

Before you start just know that quitting is not an option. Have a pep talk with yourself so you can be committed to this. Really hone in on why you are doing this to keep you motivated. Even get a friend or family member to be your accountability partner to help you stay the course and make sure you’re taking action. Another important initial step is to identify when it’s time to ask for help. For example if you see that you’re still overspending after a specific amount of time you give yourself then you need help. Or let’s say you tell yourself you’ll track your spending on a weekly basis but instead only get to it once a month then go get help.

Tips to make your paycheck budget a success

If you share finances with another person then you have to make sure both of you are involved. This is so important especially when you’re married. You both need to be on the same page so be sure both of you know where the spreadsheet is to update and have regular weekly meetings. For this reason I love Google Sheets because it allows you to share the document and you’re able to see the latest version in real time.

Take cash out once per period for your day to day expenses. This can be stuff like groceries , gas and eating out. Doing this will make it like a bill instead of continuous various withdrawals you make for these type of expenses. To determine how much you need will be trial and error. You will have to really think about your day to day spending that you put on your credit card.

Overestimate your bills to ensure you have enough to cover your expenses. For example if your electricity bill ranges between $150 to $250 then pick the higher amount to make sure you are covered.

Figure out your non-recurring expenses. Make sure to do this after you’ve got your day to day spending dialed in and know the cash you need to take out every paycheck. Non-recurring expenses can be things like gifts, vacation and car repairs. Come up with a monthly amount to save. This way if something like your car breaks down then you already have money stashed away just for this particular scenario. You can save this money to a separate checking account that is separate from your checking account that you use for your day to day spending.

Have a plan for your extra money. If you decide in advance what you’ll do with the extra money then there will be less of a chance that you waste it because you treat that as free money. Get that extra money going towards your goal and you’ll be paying off your debt or going on that vacation in no time!

Try to create a spending plan three months in advance. It’s ok to start out with maybe two weeks ahead and work your way up to 3 months. Just be sure to do weekly check ins. There are so many different expenses throughout the year. Creating a plan this far out gives you a better idea of your cash flow and overall picture of your spending. It lets you be more proactive because you’re able to see the expenses that are coming up and plan ahead.

Be flexible with your spending plan. When you’re starting out not everything will be perfect because it’s still possible for expenses to creep up and that’s ok! Life has a way of throwing us curve balls every now and then so your spending plan is meant to be flexible. The good thing is that at least this will keep surprises to a minimum.

Your New Spending Plan and Paycheck Budgeting System

Be sure to give your spending plan two months to get a handle of your day to day expenses. Mark it on your calendar! Like I mentioned before, for the cash portion you’ll start out with a guess so two months will give you some time to tweak it. If by the end of this time frame you’re not seeing progress then it’s time to re-evaluate and try something different. Ask yourself what’s giving you the most issues. Is it lack of time? Are you seeing that you’re not truly committed? Are you not being consistent? Do you still see yourself in crisis /reactionary mode instead of being proactive? Does it seem like too many expenses to handle? Is it hard to make adjustments?

Try to improve your paycheck budgeting system the best you can and just keep going. Don’t be afraid to get help. The biggest value a financial coach can provide is to help you be committed and help you be flexible with the results. If you feel you can benefit from financial coaching then please don’t hesitate to schedule a free call.

Need help with your spending plan?

LET'S GET ON A CALL TO GET STARTED!